Property Tax Reform Proposal

Fuel tax pays only about 13% of road construction and maintenance costs. The transportation system is very expensive and makes other infrastructure more expensive as well. This is a big reason for high taxes. (revenue projections)

Most Important Reform

My proposal for property tax reform will reduce and stabilize property taxes. The most needed reform in the Texas property tax system is to change the property appraisal method. I propose that property taxes be appraised using a combination of rental value of properties and household income levels. This will stabilize property tax amounts and maintain taxation levels that are consistent with the public’s ability to pay these taxes.

Reduce and Stabilize Property Taxes

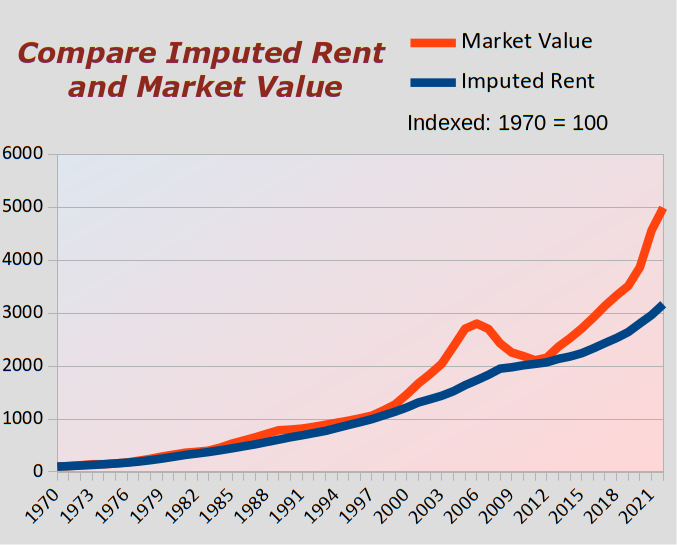

The current system uses real estate sales as the basis of appraisals. There is a basic problem with this method because it fails to account for the "boom and bust" cycle in real estate prices. As shown in the graph, the "imputed rental value" is much more stable than the "market value" of residential property. Imputed rental value is the Bureau of Economic Analysis estimate of rent values used in the Consumer Price Index (CPI) calculation. The current property tax appraisal system uses property sales —so called “comparable sales” —for tax assessments. Since the "market value" of real estate rises quickly in the boom phase of the cycle, property owners are caught with large increases in property tax that far exceed the rise, if any, in household income. As we see in the graph, the market value has continued to exceed rental value, resulting in property tax increases that exceed household income increases

The real estate boom and bust is part of a credit cycle and, in my opinion, the Federal Reserve monetary inflation process. The monetary inflation process begins with increasing the mortgage loan amounts for real estate. With higher loan amounts, real estate prices begin to increase. Increased real estate prices induce more sales and also attract speculation and stimulate suburban development, which reinforce the price increase trend. Higher new mortgage amounts allow existing mortgages to be paid and replaced with the higher loan amounts. This also increases the money supply in the economy, increasing economic activity and creating the appearance of economic growth. This pattern will persist for several years and eventually be recognized as a real estate bubble. Over the course of a longer period, the monetary inflation from the real estate bubble will work its way through the economy, appearing as increased rents, increased consumer goods prices, and finally as increased wages and salaries. Note that the real estate price inflation occurs many years before the wage and salary inflation.

The real estate bubble will drive real estate prices to unaffordable levels and will eventually end as speculation decreases. This is usually accompanied by a rise in interest rates by the Federal Reserve, which tends to reduce speculation and, with a significantly delayed effect, moderates consumer goods price inflation. Inflation of the money supply decreases and the economy enters a recession. Over a time period of more than a decade, wages and salaries will have inflated to the level where real estate becomes relatively more affordable, which sets the stage for the real estate inflation process—the boom and bust cycle—to begin again. However, the process usually results in a situation where real estate prices are higher in relation to incomes and not returning to the affordability level that existed before the real estate bubble.

To further refine the property tax system to account for Federal Reserve monetary inflation, we should implement an “increased mortgage interest tax,” which would be payable by the owner of the mortgage debt and which would be enforced by requiring that the “increased mortgage interest tax” be paid as mortgage payments are received and prior to any foreclosure action or other transfer of the mortgage or the property. This tax would be based on the part of the mortgage that is higher than the appraised value of the property before the the mortgage debt was incurred.

Incentives for Government

The present property tax assessment system tends to inflate values at the beginning of the inflation process, since recent sales will be for a higher price, especially during a credit induced real estate bubble. This system also leads to higher tax revenues for government, which creates an incentive for state and local governments to promote real estate bubbles and maintain high property prices—favoring price rises and opposing price decreases. This also means that local governments are aligned with the banking cartel and property developers and against the local citizenry. This alignment is counter-productive because it results in an economy in which property ownership is unaffordable for the middle class and in which money is increasingly transferred out of the local economy to Wall Street banks and corporations.

The rental value of property is directly related to the local income level. Under my proposal to base property tax assessments on local rental value and income levels, the incentive for the government will be to seek to increase household incomes. This will incentivize local and state government to focus on ways to promote better paying jobs and more successful small business. The incentive will be to promote household incomes because rental payments are dependent on local income levels and are not financed by the banking cartel. In addition, cities will become more focused on making urban spaces more appealing, livable, and more accommodating to residents while rural areas will seek to increase jobs and business opportunities.

Benefits to the Public

While no one likes paying taxes, we must realize that Texas is our state and we have to pay for it. The American reformer, Henry George, proposed that all taxation be based upon land rent value. It is quite possible for local and state government to provide valuable services to the public that are worth the tax bill. Local and state government spending that is wisely allocated circulates money in ways that are beneficial to the public and helps the economy. It is said that taxes are one of the inevitabilities. The issues are whether property taxes are fair and reasonable and whether the public is receiving good value for property tax payments. To accomplish the goal of government providing good value to the public, we must create the incentive system that will produce that result. By relating property tax assessments directly to the economic situation of the local population, local and state governments will have a direct incentive to help improve living standards and economic well being and to place the public welfare as the highest priority.