by Alexander Del Mar

| Author: Alexander Del Mar; | Source: archive.org |

The Science of Money

Price 15s. net.

BY THE SAME AUTHOR.

A

HISTORY

OF

MONETARY SYSTEMS

IN

VARIOUS STATES.

THE SCIENCE OF MONEY

BY

ALEXANDER DEL MAR, M.E.

FORMERLY DIRECTOR OF THE BUREAU OF STATISTICS OF THE UNITED STATES OF

AMERICA; MINING COMMISSIONER TO THE UNITED STATES MONETARY

COMMISSION OF 1876; AUTHOR OF A "HISTORY OF THE PRECIOUS

METALS," A "HISTORY OF MONEY," ETC., ETC.

SECOND EDITION—REVISED BY THE AUTHOR

LONDON

EFFINGHAM WILSON

ROYAL EXCHANGE

1896

All rights reserved

AMERICAN COPYRIGHT NOTICE.

The first Edition of this work was duly entered according to Act of Congress in the year 1885 by ALEXANDER DEL MAR in the Office of the Librarian of Congress at Washington, D.C.

INTRODUCTION. ^

vii ALTHOUGH the commercial world has not yet recovered from the disastrous consequences occasioned by the de-monetisation of one of the precious metals, and the engrossment of the other by the money-lenders of the Continent, the recent increase of the gold product is awakening the attention of another class of money-dealers who are already discussing the means of avoiding what appears to them a grave peril to their interests. In other words, a section of Lombard Street is regarding South Africa precisely as La Haute Banque viewed Nevada thirty years ago; and the proposed remedy will probably be of similar character. The reply to Nevada was to close the mints to silver, and keep them open for gold; the reply to South Africa will be, to close them to gold, and reopen them to silver.

Apart from other considerations, the present vast consumption of gold in the arts renders it improbable that the vacuum caused by the demonetisation of silver will ever be filled with gold, whether from Africa or elsewhere. As to the note of alarm which has been sounded by the organs of usury, its sincerity may well be doubted. But assuming it to be both sincere and well-founded it is time to declare in the general interest that this huge see-saw between gold and silver money shall not be permitted to again disturb the affairs of commercial states. Agriculture, Manufactures, Trade, Professional services and Labour, all of which have suffered from the de-monetisation of silver, will demand a clear understanding upon the subject, and the establishment of money in each viii State upon such an equitable and permanent basis as will satisfy the requirements of justice and of an advancing civilisation. There is no desire to weaken the security of capital, nor to deprive it of its just reward; there is no desire to inflate, any more than there is to contract the currency; there is no desire to experiment with untried moneys or untried principles: but there is a resolve that the monetary mechanism shall no longer be subverted to the intrigues of a few avid men, whose gains have already been so enormous that their presence in a State has come to be regarded as a source of danger. In short, the promotion of under-handed legislation concerning money can no longer be tolerated. There must be no more pompous Latin Unions, created to dupe the vain, trap the unwary, and enlist the treacherous; no more surreptitious suppressions of Royal Prerogatives; no more Mint Codes, to be read by title and enacted in secret; no more deceptively Revised Statutes, to be passed en bloc; and no more incumbents of high office betrayed or allured. These disgraceful devices and practices are of the past; in future, the noisy clamourers for "honest money" must bow to the decision of the State on this subject; or, like the Tarpeian woman, they will be left to perish beneath the objects of their own avidity. Although the gold of South Africa is being produced at the present time with labour which costs but £3 month, the system has to be sustained by methods that are rapidly exploiting the labourers, and may render it necessary ere long to recruit them from the working classes of Europe; an event that will entirely change the bearings of this industry.

If an equitable settlement of monetary systems can be brought about, the past thirty years of financial intrigue, and the industrial distress to which it has led, will not have been suffered by the community in vain. For two hundred and odd years the goldsmith and money-lending class have used a Public Measure —the coins of the realm ix —as an instrument of their own enrichment and aggrandisement; in this design they have not scrupled at dissimulation, treachery, the employment of bribery, or the altering of ancient statutes. But this is all over now; South Africa has followed too closely upon the heels of the silver demonetisation. The present generation cannot again be inveigled into an alteration of the monetary laws, either in or out of an international convention, without scrutinising very closely the character and bearing of the proposed alteration. The anticipated plethora of gold, should it occur, will hoist the goldsmiths with their own petard, and in all future settlements of the currency question, they will have to come to terms with Industry, or else stay where the petard will leave them.

It is therefore timely to discuss these terms. Previous to the reign of the Stuarts, the entire institution of money was in the hands of the State. Said Malynes, writing in 1603: "Money being the Public Measure to maintain a certain equality in buying and selling, must therefore have his (its) standing valuation only by public authority of Princes, as a matter annexed to their crown and dignities; for they be the warrant of the money unto their subjects. And to the end that this Measure of Things, namely Money, should not be falsified, by making the same generally more or less (whereby the price of things would become incertain, if private men be suspected to have the handling thereof), therefore, are Princes so careful to observe a certainty and equality of the price of Money from time to time."

The decision rendered by the Privy Council in 1604, given at length in the present work, established the Public and Social character of money even more distinctly and emphatically. It recognised money as a Measure, whose equitable operation could only be secured by the State, which therefore was alone entrusted with the power to "make the same generally more or less" (as Malynes puts it), by x increasing or diminishing its volume, or altering the composition of its symbols. The Council sustained these principles by an array of philosophical authority and legal precedents, which extended backwards to the remote æra of the Greek republics, and which is not without its echo in more recent opinion.1

But the plunder of India and America which occurred during the Stuart dynasty, overthrew both law and philosophy. It rendered abortive every attempt on the part of the Bench, even of the Crown, to retain for the State the time-honoured and necessary prerogative of Coinage. Scipio's plunder of Spain, his destruction of the nummulary system of Rome, and his intrigues and embezzlements of the opima spolia, were enacted all over again.

First at Goa, afterwards in Spanish America, and eventually in Holland and England, the avidity of the plunderers abroad and of the money-lenders with whom they were in league at home, broke down every safeguard of the law, destroyed every limitation of the monetary measure, and reduced money to the degraded position of metal, or ponderata. This was done by legally permitting individual or private coinage, subject to the stamp of the mint. Under this law the owners of bullion could increase the currency by having their metal coined, or diminish it by melting the coins, and so could alter the Measure of Value at pleasure without loss or expense; the State even consenting to perform gratuitously the mechanical work of coinage and the detective work of incriminating counterfeiters. Such was the practical outcome of the Act of 1666, and such is the law to this day. A more senseless and mischievous Act was never procured.

Upon the working of this law was erected an entirely new and fallacious theory concerning the Wealth of

1 To put this currency upon a proper footing it is indispensable that it should be issued by Government, and Government only." Sir Archibald Alison's History of Europe, Vol. VIII., p. 119.

xi Nations, its origin and its mode of increase; a theory which was never heard of before, and will not be heard of again whenever the coinage and the melting down or exporting of the national Measure of Value shall cease to be prostituted to private cupidity. The name which has been given to this law and theory is the Mercantile System: its proper name is Metallism. It assumes among other things that value is an intrinsic attribute of matter, the expression "intrinsic value" occurring so early as the Dutch Mint Act of July 21st, 1622; that exchange, even in civilised States, is conducted upon the basis of the cost of production; and that money is and must necessarily be a commodity, valued as such, namely (so runs the theory) at the cost of the production of coins, which cost, in most cases, down to that time, was in point of fact chiefly rapine, slavery and murder. All of these assumptions are taught and widely entertained at the present day. Neither of them, as this work will endeavour to show, has any foundation whatever in fact.

Value is a numerical relation; it is not inherent, it is not intrinsic, it is not an attribute of matter, it does not exist in the isolated state, it only occurs in the social state, and is determined solely by exchange. Value is measured not by the circumstances of production, but by those of exchange. The value of a commodity is the number of other commodities it will fetch in exchange; it is not the efforts nor the things that the commodity cost to produce or may cost to reproduce.

The value or purchasing power of the gold produced by savage labour in South Africa or coolie labour in Asia does not and will not follow the cost of its production, but will be derived from its parity in the exchanges. The cost may (or it may not) affect the quantity produced, and the quantity may (or it may not) affect the value; but cost has no necessary nor direct influence upon value, which arises immediately from exchange. Go into the bourses of the world, and ask those dealers whose transactions embrace xii the principal exchanges in finance and commerce if they buy or sell upon the basis of the cost of production, and they will smile at the simplicity of the question. Yet these dealers, when, in some unprofessional movement, they air their own knowledge of political economy, will tire you out with this same cost-of-production theory which they have inherited from the schools, and which, though totally unknown to their practice, still lingers upon their lips.

Upon what basis, then, it may be asked, are commodities and services exchanged, not in the remote past, not among savage or semi-civilised communities, but now, and here, in the commercial States of Christendom? The answer is: Upon the basis of number, the relative numbers of commodities and services offered for exchange in a given time. And the just measure of this numerical relation?

Is Money. This, in each State, consists of a limited number of Denominations impressed upon ponderable symbols, which are legally receivable for public rates and taxes, and payable for private debts.

And Price?

Before going any further with this catechism, let it be observed that the principles conveyed in the answers are not drawn from the realms of dogma, but from the practical workings of monetary systems that cover a period not merely of two, but of twenty-five centuries, and from precepts which are embalmed in legal codes of great antiquity, which principles, therefore, constitute all that we have any right to regard as the Science of Money. They may appear unfamiliar to those who have been educated in the schools of the prevalent system; but the Bench continues to recognise them, and practical men employ them in their everyday transactions. In short, they are sanctified both by law and custom.

To say that Price is value expressed in money is to give a definition where an explanation is required. Such an explanation may best be afforded by means of an xiii illustration. If, in a given community, it were necessary for the purposes of distribution to transact a thousand exchanges per diem, if the subjects of each exchange proved to be of equal value, and the money of such community consisted of a thousand "sovereigns" with a circulating velocity of once a day, the price of each commodity or service exchanged would necessarily be just one "sovereign," no matter whether the "sovereigns" cost much or little to produce, no matter whether they were made of gold or glass. A change in either of the factors would result in a change of price. If the exchanges were more or less rapid, prices would change; or if the money circulated more or less rapidly, prices would change. In a certain sense, therefore, price is a relation between two velocities.

A London bill-broker recently favoured the author with the following rough estimate of the exchanges and circulating money of the United Kingdom; exchanges, about 23,000,000,000 of pounds a year, say £23,400,000,000; circulation (including coins, notes, bills of exchange, promissory notes and open accounts, all reduced to a like velocity of use and re-use), £130,000,000, with a mean velocity of once in two days, or 180 times a year. Therefore 130 × 180 = 23,400 millions a year, identical with the annual sum of exchanges. The result of this equation is the present level of prices. It is evident that if either of these factors were changed, prices would change; and that this would occur, and would have to occur, without the slightest reference to cost of production. It is not denied that cost of production has an important relation to price; what is asserted is that after price and cost of production have mutually affected each other to the utmost extent, price has to undergo a further modification, one that has no relation to cost of production, but only to money and exchanges and to their relative velocities.

"Whether par pro pari arose teleologically from the xiv desire of personal safety, or military ascendancy, or from equality of service or sacrifice, or from passion or caprice, it is not the province of this work to inquire. Practical Science knows nothing about first causes. The remote origins of customs may with advantage be left to the researches of antiquarians. The practical world wants a working theory or explanation of money as it now stands in law and fact; a theory which explains precisely what money does, and precisely how it does it. The explanation is, that money measures value by expressing it in price, and that price is a numerical relation expressed in the symbols of money, a relation between two sums and velocities, the sum of exchanges in time, and the sum of the circulation in time. The illustrious John Stuart Mill distinctly laid the foundation of this theory when he said that "the value of money is inversely as its quantity multiplied by what is called the rapidity of circulation". Our merchants tacitly recognise the theory when they consult the bank clearings and discounts, because these indicate the increase or diminution in the sum of exchanges which is to be measured by money; they act upon the theory when their transactions are guided by the shipments or movements of gold, because, as the law of money now stands, these movements rudely mark the shrinkage or augmentation of money in the State. If money ever ceases to be made of the precious metals, the merchants will have fewer of these distracting indications to watch; they will be enabled to concentrate their attention upon their own proper province, the movement of commodities, and to leave money, as they now leave the regulation of other public measures, to the custody and consideration of the State.

Since the enactment of the law of 1666, which destroyed Money as a Public Measure, and surrendered the regulation of its volume to private hands, those hands have, through its powerful agency, grasped control not only of all the metallic money, but also of a considerable xv portion of the other wealth of the kingdom. Among the various devices procured or employed by them have been:

- I. Frequent alterations of the ratio between gold and silver coins. These alterations have since been ascribed to the work of nature, the operation of the market, the caprice of princes, and a variety of other fanciful causes. The petitions, cahiers and plakkarts of the period to which they refer, prove that they often originated with the money-lenders themselves.

- II. Changing the material of full legal tender coins from gold to silver, or silver to gold.

- III. Issuing convertible notes upon an inconvertible basis.

- IV. Alternately swelling and shrinking the currencies of particular States, by monopolising the produce of mines, shipping bullion to and fro, transferring securities from one State to another, speculating in exchange, and other like practices.

The colossal profits of these operations have been drawn from the channels of Industry, which now demands, not yet an indemnity, but such a settlement of the monetary laws as will cease to afford facilities for their repetition.

The basis of such a settlement must be the re-establishment of the Royal Prerogative of money, that complete restoration of its control by the State, without which experience has abundantly shown that the preservation of equitable relations between the various individuals and classes of society is utterly impossible. The time of this settlement should not be longer delayed. The real or fancied interests of money-lenders may deter them from urging any change in the coinage laws until the anticipated flow of gold from Africa and Russian Asia becomes more marked. But the requirements of justice and the welfare of the industrial classes demand reform at once. By such reform is not meant the abandonment of gold and silver coins, but an abandonment of the law of private or "free" coinage. The details of the settlement may safely be left to the wisdom of the Executive Government. They should embrace a provision that the banks may xvi retain their existing privileges of issuing circulating notes, but subject always to the control of the State, so that such notes may form a fixed and definite portion of the whole Measure of Value. In short, the essential reform of Money which is suggested by the study of its history and principles, is the repeal of that clause of the Act 18 Chas. II, c. 5, which gave to "private men the handling thereof".

xxCONTENTS. ^

Exchange. Exchange is a social act—The Greek, Roman, and French philosophers deemed exchange and money as part of the structure of society—Barter—Distinction between barter and selling for money—Essential characteristics of money—It constitutes a public measure—Barter leads to slavery; money to freedom—Effigy of Liber Pater on ancient coins—Its significance—Enslavement of the Frisians—The dangers of metallism have given rise in modern times to an increasing proportion of paper promises to serve as money—Dangers arising from their assumed convertibility … 1

Value is a Numerical Relation. Legal use of the words "unit of value"—Their importance—They are not defined in the law—Unit a synonym for measure—Evolution of the word "value"—Its classical meaning related to the power of numbers—During the Dark Ages it became associated with labour—In the Renaissance it acquired the meaning of an attribute of matter—Fallacy of this last view—The correct nature of value rediscovered by Montesquieu and Bastiat—Value shown to be a numerical ratio between all exchanged things—Value measurable by the whole numbers of money The existing mint laws practically make the whole numbers of money (or the unit or measure of value) to consist of an indefinite sum, whose only limits fluctuate between illimitable demand and uncertain supply … 7

Price. It is the expression of value in money—Price implies precision—It is intended to be a precise expression of value—But this it cannot be unless the whole sum of money is limited and known—Harris, Smith, Mill, Locke, Hume—Price cannot be definitely expressed in a single coin independently of others—Prices of commodities tend to fall; of services to rise—This tendency defeated by private coinage and the monopolisation of gold—Price not due to cost of production; it expresses a dynamical or kinetic relation between money and exchanges in time … 20

Money is a Mechanism. Money is a mechanism designed to measure value with precision—The law alone can determine what is and what is not money—The function of money correctly understood by Aristotle—During, or shortly previous to, the æra of that philosopher, the volume of money in each country was limited, and it formed a definite measure of value therein—It is now everywhere unlimited, and has lost its character of an exact measure—Money at present is not denned in the laws. For this reason it is unlike all other measures—Money is intended, but not now fitted, for a measure—The size or weight of a dollar or pound sterling furnishes no guide to the whole number of dollars or pounds: yet it is this which constitutes the measure of value—The measuring function of money is altered with every change in the whole number of so-called units of value—Not so with the units of weight, length, volume or area … 25

Constituents of a Monetary Mechanism. Control over the precious metals—Mines royal—Treasure trove—Control of the coinage—Use of two or more metals for coins—Coins as numerical symbols—Size, weight, fineness and shape—Mark of authority—Denominations—Compulsory use—Legal-tender—Restrictions upon hoarding, melting, or exporting—Counterfeiting—Interdict of private coinage—Taxes on mining, etc.—Most of these regulations are now overthrown—Private coinage has degraded money to metal—The use of metal in place of money reduces all commerce to the basis of barter—Numerous States have avoided this by resorting to paper systems, and this tendency is increasing—The demonetisation of silver is promoting that of gold … 57

History of Monetary Mechanisms. Evolution of money—Barter— Valuing commodity—Baugs—Coins—Their defects—Nomisma—Its downfall—Coins subjected to legal and sacerdotal regulations—Monetary systems of the Roman Empire and of European States—Coinage Acts of the sixteenth century—Origin and progress of private coinage—Private money, or metallism—This is the present phase of monetary mechanisms—It is virtually a return to barter—Its consequences have been the enrichment of money-lenders and the impoverishment of States—The remedy adopted in many States has been paper systems … 60

The Law of Money. The Greek law—The Roman law—The Common law—Philip leBel—Decision under English law—Corn rents—The Code Napoleon—The Court of Cassation —Decisions of the United States Supreme Court—Metallic theory—Black Laws of James III. of Scotland—Special Contract Law of 1878—Disastrous effects of this legislation—Imperative demand for its repeal—The Law of Nations relative to money … 95

The Unit of Money is All Money. Origin of the word "money"—Its employment with reference to any period before B.C. 273 an anachronism—Money, or nomisma, meant originally the whole numbers of money—This was its classical meaning—During the Empire and the Dark Ages money came to mean one or more coins—This is the meaning attached to it in the laws of modern nations, because these laws originated in the Dark Ages—During the Renaissance it meant the whole quantity, not numbers, of money—This is the meaning sometimes attached to it by the Economists, because their systems date from the Renaissance—Incongruous nature of this definition—In speaking with precision, money can only mean all the numbers of money of a given country—Ideologically, the unit of money is all money … 109

Moneys Contrasted With Other Measures. Differences between moneys and other measures, even when both are limited—1. Money is used to determine the value of numberless things at the same time; a yard-stick to determine the length of one thing at a time—2. Money determines a dynamical and variable relation; other measures, a statical and fixed one—3. Money determines a numerical and extrinsic relation; other measures determine quantitative or qualitative attributes—4. Money determines an equitable relation; other measures determine quantities which have no connection with equity—5. Moneys have a tendency to instantly amalgamate, and two or more moneys will merge into one money of the combined volume of both, which is not the case with other measures … 123

Limitation is the Essence of Moneys. Resemblances between money and other measures—All measures of precision are of artificial dimensions—To become a precise measure money must also be of artificial dimensions—All other measures are susceptible of exact numerical expression—To become a just measure money must be defined numerically—The efficiency of all measures, money included, depends upon the exactness of their limits, not the substance of which they may be composed—The limits of other measures are not left to be determined by supply or demand, nor should be those of money … 127

Limitation: A Perogative of State. The limitation of the monetary measure was anciently a prerogative of State—Its surrender by the State in the sixteenth century—Since that period money has been in a chaotic condition—The "automatic system" is no system at all—Neither individuals nor corporations can regulate money—The State alone can do this—Nor may the State do it arbitrarily—Circumstances and considerations that should control State action on the subject … 130

Universal Money a Chimera. This project was born with the legislation which permitted private coinage—Its progress down to the present time—Its agency in elevating and enriching the moneyed class—Their advantages threatened by the growing use of government paper money—Universal money is a scheme to enable these advantages to be retained by the money-lenders—Its impracticable character—Universal money impossible without universal government—Evils and dangers of national metallism—These are now local—With universal metallism they would become general—It threatens the autonomy of the State—It tends to degrade Europe to the level of India—Absolute measures of value—The basis of "universal money" is the cupidity of the money-lenders … 134

Causes and Analysis of a Rate of Interest. Causes of a rate of interest—Temporary supply of money—Rate of profit in trade—Rate of profit in production—Rate at which animals, plants and minerals increase—Rate at which the means of subsistence increase—Subsistence ultimately governs the rate of interest—Subsistence also governs the growth of population; so that population and the rate of interest are related—When to the rate of interest, arising from increase of subsistence, there are added allowances for risk, taxes, and the cost of superintending loans, the market rate of interest follows—Present tendency of the market rate—Ignorance of American ministers of finance—Usury laws … 142

Velocity of Circulation. Opinions of Locke, Thornton, Mill, and Fawcett—Elements of the calculation—Money used for paying labour—Money and credits used for commerce—Transportation Finance—Real estate transactions—Money used for insurance—Savings—Taxes—Summary—Comparison with actual circulation and reserves—Deduced rate of velocity—Unwarranted conclusions of Mr. Horr and others—Coincidence of the sum of exchanges with that of money and credits, when reduced to a like velocity … 148

Relation of Money to Prices. Given the level of prices and the sum of exchanges in time, the sum and velocity of the circulation are deducible—Prices have nothing to do with the material of money—Nor value with the names of coins—Blunder of striving to maintain metallic systems with private coinage—Voice of authority—Logic of events—Nearly every modern State has been obliged to abandon such systems—Example of Russia—False principles deduced from metallism—Different influences on prices and trade, of metallism and numerical money … 164

Increasing and Decreasing Moneys. The fallacy that value flows from labour—Dr. Smith and Bastiat—Error of supposing that the currency of a State cannot be artificially increased—Historical examples to the contrary—Milan—Spanish America—The United States during the Civil War—Crescendo and diminuendo moneys … 170

Effects of Expansion and Contraction. Consequences of increasing and decreasing moneys—Their influence upon trade, upon social and domestic relations, upon character, upon genius and invention, upon morality, upon crime, upon political affairs—Opinion of the Monetary Commission—Social consequences of contraction—Opinion of Mr. Tooke—Influence of expansion upon enterprise and art—Money and civilisation—The halcyon age of Europe … 177

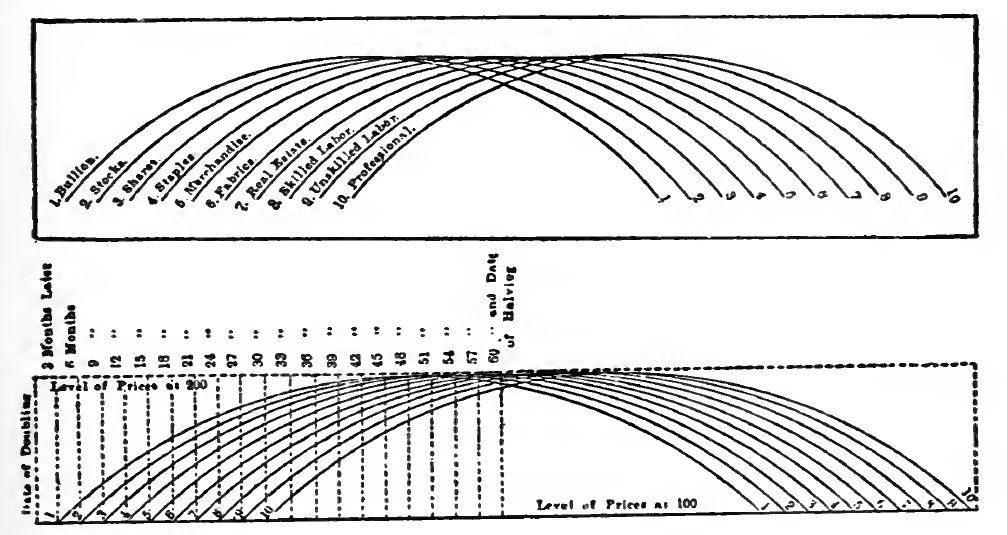

The Precession of Prices. Explanation of price—It cannot be expressed in a given coin or sum of coins independent of other coins—It varies directly with the whole numbers of money—Logically a doubling of money will instantly effect a doubling of all prices—In point of fact, this doubling occurs in time, and the time varies in various States and with different commodities—This variance subject to natural law—Such law called the Precession of Prices, or Movement of Prices in Time—Results of practical observations on the working of this law—Danger of employing a money without fixed limits—Other practical observations concerning moneys … 184

Revulsions of Prices. Coins are made of gold and silver not because of the intrinsic qualities of these metals—The practice arose from the superior constancy of their quantity as compared with other substances, and during æras when artificial moneys of fixed quantity were politically impracticable—Historical examples—The precious metals were never permanently used for coins until the conquest of Spain by Rome—When the first effects of this conquest subsided, the precious metals were less used as materials for coins, until the Spanish conquest of America—The effects of the conquest of America and its great supplies of gold and silver to Europe upon prices have been sustained by means of convertible paper notes—This system incapable of further safe extension—Necessity for reform in money—Fluctuations of prices which have resulted from the failure of "convertible" note systems—Their disastrous and baneful effects … 190

Regulation of Moneys. Fluctuations of price which do not belong to the domain of science—Variations which do—Practical considerations for the regulation of money—Effect in the United States of an absolutely fixed sum—Influence of a fixed sum per capita of population—Actual movement of population and money during the past century—Had money been regulated instead of being left to commerce, chance, and political contention, the great panics of 1815, 1821, 1837, 1861, 1873, and 1893 might have been averted … 197

THE SCIENCE OF MONEY.

CHAPTER I. ^

EXCHANGE.

Exchange is a social act—The Greek, Roman, and French philosophers deemed exchange and money as part of the structure of society—Barter—Distinction between barter and selling for money—Essential characteristics of money—It constitutes a public measure—Barter leads to slavery; money to freedom—Effigy of Liber Pater on ancient coins—Its significance—Enslavement of the Frisians—The dangers of metallism have given rise in modern times to an increasing proportion of paper promises to serve as money—Dangers arising from their assumed convertibility.

EXCHANGE is a social act; no man can exchange with himself. Exchange therefore implies society. That "it takes two to make a bargain" is axiomatic. We shall presently see that value, which is the basis of exchange, has also a social origin; and that money, when it is designed to be a correct measure of value, is, and must of necessity be, a social instrument. The Greek philosophers regarded exchange and society as inseparable. Said Aristotle: "There would be no society if there were no exchange, and no exchange if there were no money".1 The writings of Paulus and other Roman jurisconsults prove that they also were imbued with the same conviction. The modern French philosophers were of a similar opinion. Said Destutt Tracy: "Society is in fact held together by a series of exchanges". 2 Said Frederic Bastiat: "Exchange is political economy—it is society itself; for it is impossible

1 Book V., on Justice.

2 Econmic Politique, p. 78.

2 to conceive society as existing without exchange, or exchange without society".1 The reason given for this opinion is, that "in the isolated state our wants exceed our powers, whilst in the social state our powers exceed our wants"; and this they are enabled to do by the operation of exchange, which is a union of powers, the sum of which is more effective than that of our several powers applied separately or successively.2 Exchange is based upon value, not upon cost. Alfred, the cowherd, can spare one of his animals, and prefers a gold bracelet instead. Balder, the shepherd, knows Canute, the miner, who will give him twenty pennyweights of gold for three sheep. Having need of a cow he exchanges three of his sheep for the gold, and the latter for a cow. In these transactions the parities of exchange, or equivalents of value, are 1 cow = 3 sheep = 20 dwts. of gold.

This kind of exchange is called barter. No matter how intricate or involved it may be, it is only barter. It is the voluntary exchange of one specified commodity or service for another specified commodity or service, neither of which commodities is limited in supply, nor prohibited from being monopolised or engrossed by individuals, nor necessarily related to other commodities or exchanges. The fact that one of the commodities exchanged is gold, does not alter the nature of the transaction. Nor would it be altered if the gold were authoritatively stamped with its weight and fineness. It is still barter: it is commodity against commodity, or give and take. 3 The valuation is rude and inexact. It has no regard for precision: it does not consider other parities of value made at the same time and place: it takes no heed of the parities made at other

1 Harmonies, Chap. IV.

2 Yet there is a class of Socialists (the Idealists) who would forbid the use of money altogether.—Blatchford's Merrie England.

3 "What must be remarked at the very outset of the science is that exchanges, which are effected by means of an intermediate commodity, do not lose the nature, the essence, the quality, of barter."—Bastiat, Har. Polit. Econ., p. 83.

3 times and places: it ignores both the past and the future; it cannot be applied to the parities of a deferred exchange; it is not related to exchanges in general, but only to one exchange; it begins and ends with an isolated transaction.

Such is not the case with money. This is designed to measure the value of all things with equity or precision. Money measures not merely the value of certain commodities and services at one time and place, as barter does; money measures all commodities at all times and places. Barter can only measure present exchanges, each one by itself; money can measure all exchanges, both present, deferred, and involved. Barter is a measure for the use of individuals, or a petty tribe; money is the measure demanded for the exchanges of a nation.

It is essential that the radical distinction between exchanges by barter and exchanges by means of money should be clearly understood, and always borne in mind. In the example above cited, Alfred has obtained twenty dwts. of gold for his cow. Should he next desire to exchange his gold for something else, he would be obliged to find somebody who wanted gold, and was willing to give for it some other commodity or service acceptable to Alfred. This might not be easy: perhaps not practicable. But if the twenty dwts. of gold were declared by his tribe to be money, the case would be entirely altered; for then there would be created a universal demand for it, and it could readily be exchanged for any other commodity or service which Alfred might desire, and which the vendor might wish to exchange for something else purchasable with Alfred's money, whether now or at any other time. To give practicable and equitable effect to such monetary declaration it would be necessary for the tribe to control and regulate the supply of gold to the mint, in order that such gold might measure value with precision and equity; divide it into small pieces suitable for transference from hand to hand; stamp these with some mark of public 4 authority, in order to distinguish them from gold pieces not monetised; monopolise their coinage; permit the substitution of silver or some other material for the gold, in case the supplies of the latter to the mint proved inadequate; give the pieces some denomination; impose a penalty on individuals for coining, hoarding, secreting, engrossing, defacing, melting down, or exporting such gold pieces, in order to prevent the public measure of value from being altered; and provide that all public revenues and expenditures shall be paid in such pieces, that all contracts shall be expressed in them, and that no man shall refuse them without incurring a penalty. Sweep away these regulations, and the pieces will sink to the rank of a commodity, which no man is obliged to accept or pay, which has no stability of quantity or numbers, and which therefore may rise or fall in value to a ruinous extent; so that prices, if couched in such commodity, may differ enormously, even in adjacent places, and contracts based upon pieces current in a past generation may serve to enslave the present one. Such are the disadvantages, the inequities, and the dangers of barter, which money was designed to remove or remedy. The logical outcome of barter is slavery; that of money is freedom. The ancients, well aware of this fact, made the god of freedom likewise the god of money. He was called Liber Pater; and either his name, or synonym, his effigy, or his symbols, will be found stamped upon a large proportion of their mint issues.

Says Tacitus (Annales, IV., 72): "In the course of this year the Frisians, a people dwelling beyond the Rhine, broke out into open acts of hostility. The cause of the insurrection was not the restless spirit of a nation impatient of the yoke; they were driven to despair by Roman avarice. A moderate tribute, such as suited the poverty of the people, consisting of raw hides for the use of the legions, had been formerly imposed by Drusus. To specify the exact size and quality of the hides was an idea that never entered into the head of any man until Olennius, the 5 first centurion of a legion, being appointed governor over the Frisians, collected a quantity of the hides of wild forest bulls and made these the standard both of weight and dimension. To any other nation this would have been a grievous burden: to this one it was unbearable, because the cattle (called 'Uri'), which run wild in the forest, are of prodigious size, whilst the domestic breed is small. At first the Frisians groaned under this oppressive demand. Next, they surrendered their property and lands. Finally, they were obliged to sell their wives and children into slavery."

Here is an instance where payment in kind, or barter, without control over the substance contracted for, led to the enslavement of the imprudent contractors, or, what is almost the same thing, the enslavement of their wives and children. It is not the only example of the kind which history affords us. We are incurring the dangers of a barter system at the present time. Private coinage of the precious metals has almost reduced the monetary systems of the Western world to one of barter, which in many States is now little more than a system of barter for gold metal.

The regulation of metallic money was formerly secured by means of mines-royal, coinage, seigniorage, and other prerogatives reserved by the State. Since the plunder of America and India, notably since the surrender of the coinage into private hands, which in England dates from 1666, the limits of money have been, on the one hand, the produce of metals from the gold and silver mines, minus the absorption of these metals into the arts; and, on the other hand, the substitution of paper notes.

The increase of commerce, which gave rise to open mints and private coinage, has so vastly outstripped the supplies of metal to the mints, that whereas in 1666 almost the only paper moneys in Europe were the "transport notes" of the Bank of Sweden, the proportion of paper notes in 1829 was 25 per cent. This rose in 1873 and 1876 to 39 per cent, and at the present time it amounts to over 55 per cent, of 6 the total circulation of the European world, as shown in the following comparison:—

Table showing the population, stock of coined money, paper money, total money, money per capita and percentage of paper to total money in circulation in the European world (including America and the Colonies) at intervals since 1829. (Population in millions; stocks of money in millions of pounds sterling.)

| Year | Pop | Coin | Paper | Total | Per Cap | Paper % |

|---|---|---|---|---|---|---|

| 1829 | 240 | 345 | 115 | 460 | 38/- | 25 |

| 1850 | 300 | 400 | 169 | 469 | 38/- | 30 |

| 1876 | 400 | 700 | 462 | 1162 | 58/- | 39 |

| 1883 | 430 | 600 | 600 | 1200 | 56/- | 50 |

| 1893 | 470 | 550 | 665 | 1215 | 52/- | 54½ |

| 1896 | 480 | 6001 | 744 | 1344 | 56/- | 55⅓ |

Apart from the incongruity of adding together sums of money belonging to various systems, in each of which a similar coin or note has a different ratio of velocity and therefore a different purchasing power, all the systems embraced in this table consist in part of so-called convertible notes, whose convertibility fails every few years and brings on bankruptcy and commercial disaster.

The doctrine that money consists merely of pieces of metal stamped by the State in order to certify their weight and fineness, and that their value is derived from the cost of producing such metallic contents, was unknown to antiquity, and took its rise in the Mercantile system of the sixteenth and seventeenth centuries. Its emptiness can easily be demonstrated. Erase that line from the law which gives names and legal-tender to these pieces (almost the sole remaining relic of the ancient institution of money); and money would cease to exist.

1 The stock of gold and silver coins is about 800 millions sterling; of which about one-fourth is held as reserve, leaving about 600 millions in circulation.

CHAPTER II. ^

VALUE IS A NUMERICAL RELATION.

Legal use of the words "unit of value" —Their importance —They are not defined in the law —Unit a synonym for measure —Evolution of the word "value"—Its classical meaning related to the power of numbers—During the Dark Ages it became associated with labour—In the Renaissance it acquired the meaning of an attribute of matter—Fallacy of this last view—The correct nature of value rediscovered by Montesquieu and Bastiat—Value shown to be a numerical ratio between all exchanged things—Value measurable by the whole numbers of money—The existing mint laws practically make the whole numbers of money (or the unit or measure of value) to consist of an indefinite sum, whose only limits fluctuate between illimitable demand and uncertain supply.

7 THE laws of certain States ordain that either one of several different coins weighing so many grains, or of pieces of paper of such a size, each called a pound, a dollar or franc, shall be "the unit of value". Important as they are, neither of these words, "unit," or "value," is defined in the law. Reasoning from its use in analogous cases, "unit" is a synonym for measure; but the meaning of "value" is not to be determined by analogy, for there is no analogous use of it in the statutes.

When it is remembered that the ablest logicians of all countries, from Aristotle to Mill, have vainly endeavoured to give it form, it will begin to be seen how complex and obscure the nature of value must be, and therefore in what great uncertainty the statutes have involved all commercial relations, by using, without defining, this intricate term.

Nor is its use a mere matter of speech, of interest alone to pedants or grammarians. The existing law treats value as a thing, and measures our affairs and fortunes by means 8 of assumed relations to this thing, which, we shall see as we go on, is not a thing at all.

The law ordains that each one of its plural and numberless units of value called dollars, etc., shall be the measure of value in every exchange; and it compels these so-called units of value to be accepted in lieu of commodities and services, and for taxes, fines, and judicial awards. The law says, practically, "You shall pay a unit of something which Aristotle never discovered; you shall be taxed ten units of something which Mill could not define; you shall be awarded a hundred units of something which is not described in the present law, and of which everybody at the present time has a different conception".

Words are subject to an evolution which marks the course of ideas, just as—going a step further back—ideas follow the material progress of man. Thus, with the growth of the social organism words are created, refined, and specialised. With its decay they lose their special meanings and refinement; they become attached to grosser and grosser conceptions, and finally are absorbed into other words, and lost. If a societary revival occurs, and the old word is resuscitated to grow anew, the new growth may be of quite a different character from the old.

Bearing in in mind the numerical character of the ancient Greek and Roman monetary systems, the word "value," whose root is "valeo," or "power," appears to have originally become attached to the power of numbers employed as a common denominator for services and commodities. This, again, by metonym, came to mean purchasing power. In later times, when money of limited numbers had been supplanted by a coinage whose limits were controlled by the sovereign-pontiff, when the Roman commonwealth had become an empire, and the public weal was supplanted by the interests of favoured classes, the original refined meaning of value was lost, and the term became associated with grosser conceptions, until, in the Dark Ages, it was attached only to individual services, and their produce; it became a thing; 9 and it is in this erroneous sense that it is used in some existing laws.

With the Renaissance—the revival of commerce and the study of commercial facts and phenomena—the term "value" revived and acquired a new growth. From being a thing, or the associate of things, it rose to be classed with the attributes of things. It is in this sense that it is viewed by the Economists, who successively imagined that they had discovered value in the attributes of materiality, durability, difficulty or cost of production or of reproduction, utility, desirability, scarcity, etc.

Upon applying certain crucial facts to these last named views, they are seen to be erroneous. Services have neither materiality nor durability; yet the fact that they are paid for proves that they are valuable. Ideas that are not difficult to evolve often fetch a valuable consideration. Neither buyer nor seller consults the cost of production or reproduction, else there would be no great variance of value, no sudden and widespread rise or fall of prices. It would be difficult to find more than the merest traces of utility in those works of art and luxury which possess the highest value. If we look for value in desirability, both land and water, and a myriad of other things which form the first objects of man's desires, but which nature has supplied to him gratuitously, arise in view to defeat the search. As for scarcity, nothing is scarcer than a correct definition of value; but who is willing to pay for one, and how much is he willing to pay?

Unable to resolve value as a whole, the Economists attempted to manage it in parts.1 They split it into pieces, calling them variously temporary, permanent, positive,

1 "When the Turks had conquered Greece and occupied Athens, after demolishing it, they attempted to rebuild it; but the stones of which the public buildings were made, and which the ancients had handled with ease, this (then) half-civilised race found too large to lift back to their places. They were therefore compelled to break them up; and thus perished most of the beautiful and symmetrical architectural triumphs of antiquity." Leake's Topography of Athens, p. cvii. London, 1821. 8vo.

10 negative, relative, intrinsic, market, monopoly, natural, exchange, cost, and speculative, value, until each fragment was small enough for their purpose. But in vain; there always remained an element of value which neither their mechanics nor their alchemy could dispose of, and which constituted the enigma of the science. 1 Such was the importance of this element that Bastiat afterwards said of it: "Every truth or error which this word 'value' introduces into men's minds is a social one".

Some approach was made to the solution of value when its normal variations were observed to coincide with rarity or scarcity; these conditions being merely the rude forms of a numerical relation.

That the nature of value was, indeed, numerical, was somewhat confusedly indicated by the illustrious Montesquieu, whose familiarity with both the monetary history of Rome and John Law's recent experiments in France enabled him to declare that, "fundamentally, price depends entirely upon the numerical proportion of commodities to monetary symbols"; and "as the total sum of money is to the total sum of commodities in trade, so is a fraction of the one to a like fraction of the other". This does not explain value, but price; nevertheless, an attempt to explain value through the medium of price indirectly points to the numerical character of the former. 2

To the gifted Bastiat was left the task of successfully demonstrating that value did not reside in any object, and therefore could not be an intrinsic attribute of matter; that it was a relation between different objects; and that this relation only appeared during the act of exchange. Hence followed his definition that "Value is the relation of two services exchanged". 3

1 Bastiat has a chapter on this subject in his Harmonies of Political Economy.

2 See, on this subject, Wallace and Smith, in Chap. XIV.

3 Harmonies, p. 108. Jevons appears to have approached equally near to the true solution of value when he regards it as a "proportion". Primer of Political Economy and Money.

11 But, as Jean Baptiste Say very truly remarked: "It is not given to any one to reach the confines of science: philosophers mount on each other's shoulders to explore a more and more extended horizon". When Bastiat discovered the general nature of value, he stopped. He found that it was a relation, and that it only appeared in exchange. Beyond this point he did not venture.

Yet no man was ever nearer to the whole discoverable truth without discovering it. He proved that "value does not reside in matter"; "nature has nothing to do with value"; "value is a relation"; "value implies measure"; and "value is to political economy what enumeration is to arithmetic". 1 Had he taken another step forward he could scarcely have failed to perceive that value was itself an arithmetical relation; for it can only be expressed a in numbers. But death took him away before his immortal treatise was completed.

Not only is his explanation of value incomplete, it is not broad enough. Why should value be restricted to an exchange between two services? Why does it not exist as Montesquieu suspected between all services (and commodities) which are being exchanged, or liable to be exchanged?

The edifice which shelters us. for example, is not exchanged, nor being exchanged: yet it is valuable; and although that value cannot be definitely ascertained without offering to exchange the edifice for something else, it may be determined in a rude way by referring to the value of similar edifices which have been exchanged at the same place and at nearly the same time. Value, therefore, exists not merely between two commodities or services, but between all of such; it exists not only between things which are being exchanged, but, by analogy, between all things exchangeable.

The opinion that money measures the value of only

1 Bastiat, Harmonies of Political Economy, pp. 104, 107, 125, 127, 133.

12 those things which are in market, up for sale, or being exchanged, is evidently derived from contemplating the disparity between the number or magnitude of all commodities and available services and the littleness of the measure the sum of money which marks their nominal equivalent. But the sum of money is of its present magnitude simply because it was so chosen to be, or so left to become; it can be made larger or smaller at man's pleasure, whenever he chooses to exercise over it the same dominion that he has chosen to exercise over yard-sticks and pint-pots; that is, whenever he chooses to define and limit by law the magnitude of the measuring unit, which, in the case of money, is, and can only be, from the nature of things, the whole sum in use. Such increase or diminution of the sum of money will not change the value of other things one to the other; 1 it will only change the expression of it in the fractions of money, such expression being called price. Nevertheless, this price, or value expressed in money, can only be determined by the act of exchange.

In the same manner, the pint-pot is of its present size because it was so chosen to be; it would answer the same purposes and prove equally efficient, no matter what its size was made; only in case of alteration, the expression of liquid measure in total pints would be different. The numerical relations between all other things would remain the same as before.

Whatever may be the origin of the notion that value only exists between things that are being exchanged, it is evidently erroneous. The fact is that nothing is being exchanged. It never can be truly said to be twelve o'clock, for time passes eternally, and whilst we speak, nay, whilst we observe the clock, time has elapsed and escaped fixture. The act of exchange, indeed all actions, are equally unfixable; and if value pertained to objects only during the act of exchange, it would practically not pertain to them at all.

1 Mill's Political Economy, III., 7, 2, p. 298, says: "Causes which affect all commodities alike do not act upon values".

13 Value must, therefore, relate to things exchangeable as well as to those which are regarded as being exchanged; in other words, to all commodities and services.

The soundness of this conclusion is proved by the fact that when an exchange is being made, the value of all things is held in view through the medium of price. No man will sell a horse, for example, until after he ascertains not merely what the intended buyer but what all other men, within reach, will give for it. This, the latter determine, not with direct reference to the cost of production of horses, nor to the degree of their utility, nor to their lastingness nor desirability, nor to the prices of the corn, land, and labour which have contributed toward their cost, nor even to the supply and demand for horses; but simply to their price, which means their value in money. This price connects the horse, in a rude way, with all other exchangeable things at hand, and, by means of commerce and intercourse, with all exchangeable things in the commercial world. It does not follow from these premises that the price of a similar horse would be the same everywhere, because the money of each country consists of a sum by itself, a sum which is only remotely connected (if at all) with somewhat similarly constituted sums in other countries, and also because the relation between the local supply and demand for horses may not be the same in any two places.

Thus far we have seen that value is a term of the highest commercial and political importance, yet one whose definition is nowhere to be found in the law; that the term has passed through many meanings, due to its long-time use and the vicissitudes of European civilisation; that the economists of the Renaissance regarded it as an attribute of matter; that Bastiat proved it to be a relation between two services exchanged; and that further reasoning shows it to be a numerical relation, which in a rude way exists between all exchangeable things, as well as services, appears with precision during the act of exchange, and is to be measured most readily by means of money.

14 If it be asked: What is the essential character of this numerical relation called value? the reply must be, that although it depends upon many uncertain and incalculable elements, as human necessity, desire, passion, speculation, and caprice; yet that, as shown in another part of this work, it is essentially an equitable relation, or one that between equal parties has a tendency to become equitable; that it is extremely variable; 1 that it is extrinsic to and not connected with the physical properties of, nor difficulty of producing, commodities; and that it is susceptible of precise expression in numbers; and in numbers only.

Being thus susceptible of expression, it is sufficient for the purpose of dealing with it practically if value be for the present regarded as a numerical relation which involves the unknown ratio between the demand and supply of a service or commodity at a given place and time, as opposed to the unknown ratio between the demand and supply of another service or commodity at the same place and time; and that by comparison and analogy it extends to and between all services and all commodities.

In other words, value, though difficult to define, is not immeasurable. In this respect it resembles time, space, gravity, and the other primordial conditions or relations of matter. The human measure each of time, of space, of gravity, is an arbitrary standard, adopted by human law; and so must be the measure of value. It is physically

1 During the American Civil War a member of the New York Stock Exchange made a profit of several thousand dollars by accepting both of two offers which were made by different persons at almost the same instant of time, the one offering to sell certain railway shares at a lower price than the other offered to buy them at. This variation of value and double bargain must all have taken place within a half-second of time. The writer has known mining shares in San Francisco in 1878 to double and at other times to diminish one-half in value within a few hours. He has heard of an instance in the "early days" of California when the price of a common hay-scythe rose in value from 25 cents (one shilling) to 100 dollars (£20) in the course of a few days; and of another instance when plug-tobacco fell from a dollar (4s.) a pound to nothing, and was cast into the street-hollows as valueless.

15 impossible to correctly measure value with gold, silver, or any other substance, as such. Value is not matter, but a condition or relation of matter: like distance. The distance between two objects is not intrinsic to either of them: it is not a thing nor an attribute of things; it is merely a relation between things, a relation measured by miles. So value is not intrinsic to services or commodities; it does not inhere in matter, it is not a thing nor an attribute of things; it is merely a relation between things to wit, a relation which can only be precisely measured by money, and which cannot be so measured by gold or any other commodity as such.

There is no source of value, any more than there is a source of distance. There is no cause of value, any more than there is a cause of distance. The only way in which distance can be perceived and correctly measured is by means of comparison, not a comparison between two or more objects, but between two or more distances. It is the same with value: the only way in which value can be perceived and correctly measured is by means of comparison, not a comparison between two or more objects, but between two or more values. An attempt to measure one distance without reference to another distance could only end in failure: the thing is physically impossible. Yet an analogous attempt to accomplish a physical impossibility has ruled the world ever since 1666, when the numerical limits of money were sold by Charles II. to the goldsmiths of England and Flanders. This attempt consists of endeavouring to measure value with precision by means of metal as metal. It cannot be done.

Value is not merely a relation between services; it occurs between commodities. If it related only to services, or to the services employed in producing or reproducing commodities, then the cost of production or of reproduction would be a correct measure of value: but this is not true, e.g., of silver at present. Of this metal there is a superfluous stock on hand, and its present value must be below that of 16 reproduction. So with the tobacco thrown into the street-hollows of San Francisco. If, instead of the cost of reproduction, we say the cost of obtaining a like service or commodity, this only shifts the inquiry without answering it. What determines the value of a service or commodity? Answer: a like service or commodity; and so on ad infinitum. The truth is that there is no source of value. It does not arise from labour, any more than it does from crime or delusion. Several years ago a swindler imposed upon the British Museum a forged MS., for which it paid a high price. Upon what basis was this price paid? Labour? There are a million of books in the British Museum which cost more labour, but far less price. Scarcity? There are even scarcer books. Crime? Had the crime been known, the price would certainly not have been paid. The Museum authorities paid this price while labouring under a delusion,—the delusion of supposing that it was a very ancient copy of an "inspired" book. So Louis IX. paid to the Latin "emperor" Baldwin £100,000 for what he believed was the true Cross; so the Mormon Church recently offered 100,000 dollars for what they believed was the original Book of Mormon; so tens of thousands of deluded votaries annually pay sums of money to see or touch the Holy Coat of Treves. Is delusion, then, to be taken as the source of value? To state the proposition is to negative it.

Although the law at present declares that the measure of value shall consist of one single coin, it really and in point of fact consists of all coins and notes circulating within scope of the law. The law can, indeed, render one single coin the measure of value; but it can only do so by prohibiting and banishing all other coins. This it does not do. On the contrary, after declaring a single coin of a certain description to be the measure of value, it orders several hundred millions of similar coins to be fabricated; it makes them each and all payable for taxes and fines, and exchangeable for commodities, services, and each other, 17 and thus renders them altogether, in lump, one measure of value; because, as money relates to all things, and value is usually expressed in money, so value relates to all things, and not to any one thing by itself. In other words, such is the nature of value, such the law, and such the operation of the system of exchange, that the pieces of money cannot be used separately; they must be, and in fact always are, used collectively; so that the actual unit or measure of value is the whole legal or tale sum of circulating money, of whatever material or materials it may be composed.

We know already that the law has not specifically limited this measure. But has it no limits whatever? Is the measure of value a mere abstraction? No. Under existing laws it has certain rude and indefinite limits, which have been left to chance, commerce, caprice, war, intrigue, legislation, etc. These limits are roughly known as the supply of money. By rendering so much money as may be found by experiment to express the value of any object of man's desire an effective offer in exchange for such object, the law has made the demand for money illimitable. On the other hand, the supply of money in existing monetary systems is left to be determined by the march of conquest, the progress of slavery, the vicissitudes of mining discovery, the development of mining economy, the social affairs of distant nations, the happening of war, the currents of trade, the progress of the arts, the course of legislation in various countries, the plots of financiers and speculators, the melting of coins, the wear, tear, and loss of coins, the profits of banking, the emissions of State and bank notes, and numerous other events and conditions, both uncertain and unstable.

Hence we have for value a complex numerical ratio of exchange, but precisely measurable by money; and for money, a measure susceptible of precise limitation, but, as the case now stands, actually left to vary between illimitable demand and more or less uncertain supply.

Value, being a definite relation, cannot with propriety 17 be coupled with an indefinite article. "A value," for example, is erroneous. So are the expressions "great value," "marvellous value," etc., so commonly used by tradesmen. The substitution of "value" for "price," and the use of "value" as a noun or substantive, are other forms of error in the use of this term. Graham, in his excellent work on "Synonyms," also notices its confusion with the term "worth". "Value," he says, has an active; "worth," a passive meaning. The quality "worth" is what a thing has in itself; its "value" is determined by what it does for you. Worth is intrinsic; value depends on circumstances. It may be added that these circumstances relate exclusively to exchange.

Says a recent commentator on this subject: "A relation existing between two things cannot be an 'intrinsic' quality of either. Value is such a relation, just as is marriage. There is no such thing as 'intrinsic' marriage, or 'intrinsic' value, because both value and marriage refer to the reflation between two or more persons or things, and not to a thing by itself. There can be no marriage without bride and groom. There can be no value unless one thing or one service is compared, or considered in relation to other things. Were value an 'intrinsic' characteristic of gold, or diamonds, or anything else, there would have to be a new word coined to express the connection between the article so endowed by nature, and the other articles for which it is exchanged or exchangeable. Marriage is that which shows the relation of husband to wife. Value is that which shows the exchange relation of one or more things or services to others. Both marriage and value are by virtue of this fact 'extrinsic,' not 'intrinsic,' characteristics. A man is not endowed by nature with the relation of marriage, as he is with the 'intrinsic' qualities which form his personal being; and neither is any product endowed with value, as it is with the 'intrinsic' characteristics of its composition. Value being 'extrinsic' may fall or rise without affecting the 19 valued substance. Were the value of a metal 'intrinsic' it could not be altered without the application to the metal itself, of fire, or water, or a hammer, or some other physical agent. Being 'extrinsic,' being simply the relation in which the metal in question stands in relation to other exchangeable commodities, it may be altered and modified without the application of any of these physical agencies. 'Intrinsic' value is the same contradiction in terms as 'intrinsic' marriage. It is an absurdity, a misleading phrase, a finger-post pointing to economic error." 1

Value only appears in the social state, and merely applies to exchangeable things. When used with respect to health, religion, etc., or anything connected with man in an isolated state, it is a metonym for worth, as when we say a man keeps a good table, meaning that he keeps good viands. The value of money is also used to mean the rate of interest thereon at a given time and place; but this is a merely technical expression, into the merits of which it is not necessary to enter in this place.

1 Peoria Journal, editorial, 1895.

CHAPTER III. ^

PRICE.

It is the expression of value in money—Price implies precision—It is intended to be a precise expression of value—But this it cannot be unless the whole sum of money is limited and known—Harris, Smith, Mill, Locke, Hume—Price cannot be definitely expressed in a single coin independently of others—Prices of commodities tend to fall; of services to rise—This tendency defeated by private coinage and the monopolisation of gold—Price not due to cost of production; it expresses a dynamical or kinetic relation between money and exchanges in time.

20 PRICE is the expression of value in money. Value may be stated in numbers of oxen, sheep, ounces of metal, or any other objects susceptible of numerical expression; but owing to the fact that the total number of these objects is not limited or not subject to limitation, such valuation can only be rude or approximative. Price implies precision: it is, or is intended to be, a precise expression of value; and it approaches actual precision in proportion as the whole number is limited and known of the pricing symbols or denominators; because the whole number of such symbols is the only steady, stable, permanent, immovable point from which such precise measure of value can be made.

Price being the expression of value in money (meaning the whole sum of money), and value being the relation between two or more services or commodities, when exchanged or viewed as exchangeable, it follows that price is the relation between the whole sum (not number) of exchanges when expressed in money and the whole sum of money itself.

21 The very moneyers and economists, who in other parts of their books inconsistently argued that value could be precisely measured with a single coin irrespective of its cogeners, were forced to admit the stability of the whole sum of money as a measure of value. Joseph Harris (pp. 66-72), Adam Smith (I, ii., p. 178), John Stuart Mill (III., viii., 2, p. 299), and in fact the entire school of Economists, admit that "the total sum of money will always have the same value". Here the word "sum" is used as a synonym for numbers; and "value" as a synonym for measuring function, or measuring capacity, or measuring power. Stated with less ambiguity, the principle is that "the total numbers of the symbols of money of equal denomination will always have the same measuring power". If the sum is changed then the value of each constituent of the sum must vary; if the whole sum be composed of a greater or less sum of constituents than previously, the value of each separate constituent must vary inversely with the whole sum. The illustrious Mill observed this deduction, and laid it down in these words: "The value of money varies inversely as its quantity"; but the lesson has been wholly lost upon his degenerate successors.

Both Locke and Hume asserted the principle that the measuring capacity of money was governed by the total number of coins or other moneys in trade, or in circulation: it was left for Joseph Harris and Adam Smith to bury this basic principle of political economy and subvert it to the fallacious and inequitable doctrine of Metallism. 1 Mill subsequently resurrected it; but his teachings on this head were not entirely free from ambiguity, and they have lost the influence to which many of them were justly entitled. To-day some people doubt the soundness of the "quantitative principle" of money, who would perhaps have hardly ventured to question it had it been dubbed with its proper name of "numerical principle". Value is not merely a quantitative relation, it is a numerical one;

1 See Black Laws of James III., further on.

22 and when expressed in price, the expression is not merely quantitative, but numerical; which is far more exact.

Price cannot be definitely expressed in a single coin, or a sum of coins, independent of other coins; because coins are legally interchangeable one for the other. When circulating notes are legally interchangeable for coins and coins for notes, or when bullion, coins, and notes are all interchangeable, as is the case at present in the foremost States of the world, then price can only be expressed in the total sum of such composite money, or the definite fractions thereof. 1

Owing to improvements in the arts, the tendency of the value of commodities as compared with that of services is to fall. 2 In other words, the tendency of capital is to fall and of services to rise in value. This is the compensation with which Nature seeks to rectify the inequalities of fortune and the defects of distribution. There is but one way to defeat this benign process; and that way has been discovered and employed by the money-lenders. It is to alter the ancient law of money, to wrest it from the hands of the State, to acquire for themselves the privilege of private coinage, to turn money into a commodity (some commodity of limited supply and easily subject to control), and to require that all taxes, contracts, and debts shall be paid in specified quantities of such commodity, for example, gold. By monopolising this commodity the moneyed classes have got Nature by the throat and the community under their heels. They could not prevent services from rising in value as compared with commodities; that was impossible; but they have prevented services from rising in price, such price being expressed in their monopolised commodity, gold. Hence they can purchase services, and, through them, commodities, at an always falling equivalent. Compared with this process, usury is mere child's play.

It is a common fallacy to suppose that price is derived

1 See Chapter XVIII. herein.

2 Bastiat, Har. Polit. Econ., p. 150.

23 from cost of production. The fact is that price is due to an entirely different source, to wit, the numerical relation between exchanges and money. If price were due to cost of production, the English farmer would be able to sell his wheat at a profit, which, as the case stands, he is wholly unable to do. Nor is the price of wheat in England due to the cost of producing it in America, or India, or anywhere else. It is due to the relation of exchanges and money. Instead of production governing price, it is precisely the reverse; price governs production. The price of wheat being fixed by the relation between exchanges and money, those who can produce wheat below this price will go on: those who cannot, will stop; and this is precisely what the English agriculturist has been forced to do ever since the present system of money was established. Put an end to Metallism, and England will again produce her own breadstuffs; continue it, and not merely agriculture but all the industrial arts will gradually flee the country.

There is a further peculiarity of price which appears to have entirely escaped the Economists. This is its relation to time. Price is not merely the relation between money and exchanges; we shall presently see that it is the relation between money and exchanges in time. Given a whole sum of money with a given velocity of circulation on the one side, and a whole sum of exchanges in a given time, on the other, a given level of prices will be the result. But if either of these factors is changed, if the velocity of money is altered, or if the number of exchanges in time is altered, then the level of prices,— in other words, all prices,— will change, until they conform to the new relation between exchanges and money.

For example, in Chapter XIV, it is shown that the total money and credits used in place of money, employed for payments in the United States at the present time, when both are reduced to a like circulating velocity of once a week, is about 1460 million dollars. This is equal to 75,920 millions a year: thus, 1460 × 52 = 75,920. It is shown 24 that this is also the total annual sum of the exchanges, that is to say, the sales and transfers of services, merchandise, and property, for money, or credit, in that country. The result is the present level of prices, including the price of wheat. Increase the amount or velocity of the money, and these prices will rise; diminish its amount or velocity, and the prices will fall. Similarly, if the period during which these exchanges are effected is extended, prices will rise; if the period is contracted, prices will fall. Price is therefore seen to be an equation between two velocities: the velocity of money on the one hand, and of exchanges on the other; and that, directly, it has nothing to do with cost of production.

Yet it is the working of this complex mechanism and system of numerical relations, this profound kinetic problem, that every huckster in goods and amateur in science deems himself fully competent to discuss!

CHAPTER IV. ^

MONEY IS A MECHANISM.

Money is a mechanism designed to measure value with precision—The law alone can determine what is and what is not money—The function of money correctly understood by Aristotle—During, or shortly previous to, the æra of that philosopher, the volume of money in each country was limited, and it formed a definite measure of value therein—It is now everywhere unlimited, and has lost its character of an exact measure—Money at present is not denned in the laws. For this reason it is unlike all other measures—Money is intended, but not now fitted, for a measure—The size or weight of a dollar or pound sterling furnishes no guide to the whole number of dollars or pounds; yet it is this which constitutes the measure of value—The measuring function of money is altered with every change in the whole number of so-called units of value—Not so with the units of weight, length, volume or area.